OTT streaming statistics paint a clear picture of the streaming media industry’s future. Read here to find out more.

New users are flocking to OTT video platforms and spending more time watching

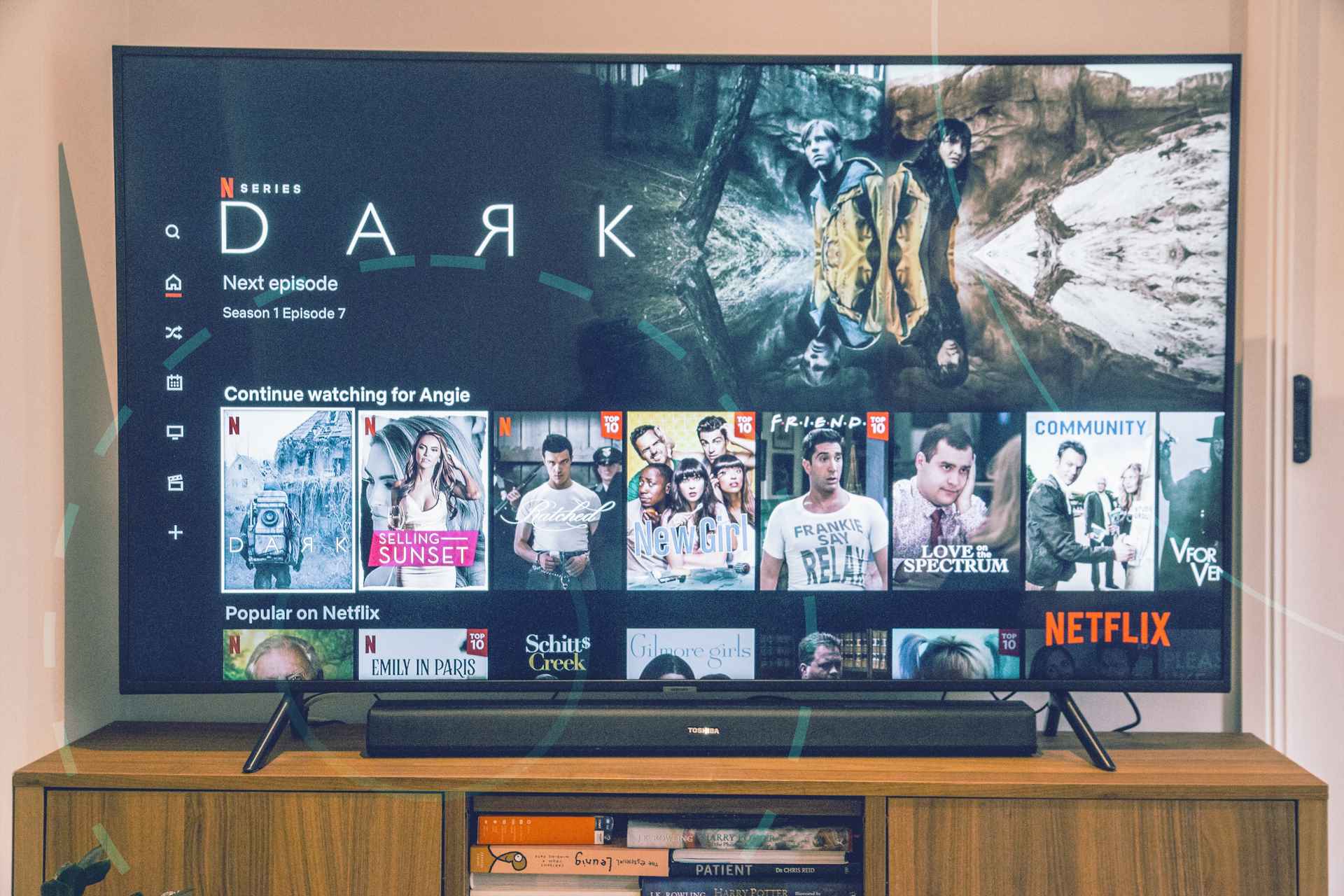

Turn on a connected TV (CTV) and open the apps menu. Where services like Netflix and Hulu sat nestled together against an otherwise barren storefront just a decade ago, the typical CTV catalog today resembles the scattershot offerings of a Skymall magazine. Even individual channels like Boomerang now offer independent paid streaming services. That any one of these services can survive speaks to the rapid growth of over-the-top (OTT) streaming, though OTT statistics paint a clearer picture of where the industry is headed. In this blog post, we’ll explore how these numbers highlight the future of streaming media, and what it means for users, advertisers, and the platform driving it all.

Want to dig even deeper into OTT, CTV, and linear TV advertising? Check out The Big List of TV Viewership Statistics [Updated for 2023].

OTT Statistics Paint a Clear Picture of Growth

The OTT industry has become a bedrock of the digital media industry, and all signs indicate that its influence will grow. According to Statista’s OTT video outlook report, revenue in the OTT video segment is expected to reach an astounding $316.10 billion USD in 2023, and the market is set to grow at an impressive Compound Annual Growth Rate (CAGR) of 10.01% from 2023 to 2027. As a result, OTT video will reach a projected market volume of $462.90 billion USD by 2027.

This growth is formidable, but it isn’t the product of finger-snapping magic. Content personalization and data-driven recommendations have played a crucial role in OTT streaming and must continue to do so for these projections to be met. Providers who invest in advanced algorithms and machine learning can provide these tailored experiences to users, boosting user satisfaction and retention rates.

“Watch next” recommendations may be the most recognized form of OTT video personalization, but advertising is the industry’s unsung hero. Marketers can leverage interactive and personalized ads to create a seamless viewing experience for viewers. OTT advertising statistics from Statista show that OTT video advertising will reach a market volume of $205.10 billion USD in 2023, making it the largest segment of the industry.

The personalized nature of OTT advertising has made it far more effective at reaching micro-segmented audiences. Ads can even be used to support free OTT video streaming services, which has become crucial for services of all sizes. A recent survey by The Trade Desk revealed that 59% of Americans are not willing to pay more than $20 a month for streaming TV services, and 75% will not pay more than $30 a month. For the majority of Americans, that leaves room in the budget for one or two subscriptions.

As popular platforms like Netflix, Apple TV, and Hulu raise their prices, consumers have even less room in their wallets to spend on new services. Selling advertising inventory can help streaming platforms offer subscription-free, value-driven services.

The OTT streaming industry is growing, and marketers have more opportunities to reach users in innovative ways. However, those who haven’t explored the channel need resources if they want to make a splash. tvScientific’s ebook The CTV Advertising Playbook has everything you need to get up to speed on OTT advertising. Download your free copy:

Key Statistics

- Revenue in the OTT video segment is expected to reach $316.10 billion USD in 2023.

- The OTT video market is set to grow at a Compound Annual Growth Rate (CAGR) of 10.01% from 2023 to 2027.

- OTT video will reach a projected market volume of $462.90 billion USD by 2027.

- OTT video advertising will reach a market volume of $205.10 billion USD in 2023

- 59% of Americans are not willing to pay more than $20 a month for streaming TV services, and 75% will not pay more than $30 a month.

OTT Streaming in the US and Around the Globe

OTT statistics overwhelmingly show that the industry is experiencing a Renaissance. But where is the growth coming from? Right now, forecasts predict that the United States is set to lead the global market, generating revenues of $137.8 billion USD in 2023. Not only are Americans investing more money into OTT video, but the time they spend using subscription OTT video services has been on an upward trend, from 44 minutes per day in 2018 to 70 minutes per day in 2022.

While the US market is the most formidable, the rest of the world is experiencing its own rapid growth. OTT statistics show the number of users globally is predicted to reach 4.22 billion by 2027, with user penetration estimated at 45.7% in 2023 and rising to 53.0% by 2027. The average revenue per user (ARPU) in the segment is projected to amount to $90.14 USD in 2023.

The rise of users around the world brings new audiences into the online fold, allowing marketers of all sizes to reach new people. As a result, marketers, users, and OTT video platforms benefit. Users get to see content that piques their interest, OTT video platforms can provide value-rich subscription tiers, and marketers can reach their ideal consumers.

Key Statistics

- The United States is set to lead the global OTT market, generating revenues of $137.8 billion USD in 2023.

- The amount of time Americans spend streaming OTT video services is increasing, from 44 minutes per day in 2018 to 70 minutes per day in 2022.

- The number of OTT users globally is predicted to reach 4.22 billion by 2027.

- User penetration is estimated at 45.7% in 2023 and rising to 53.0% by 2027.

- The ARPU in the segment is projected to amount to $90.14 USD in 2023.

The Decline of Linear TV and Rise of New Platforms

As OTT streaming services empower consumers to choose their content experience, traditional TV is facing significant challenges. Global revenue for traditional TV is expected to shrink at a -0.8% CAGR, from $231 billion USD in 2021 to $222.1 billion USD in 2026. The death of cable is a long way off, but cord-cutting is becoming a more appealing option for consumers as content libraries expand and previously gated events, like sports, find their way onto OTT video services.

OTT streaming could also benefit from the rise of new platforms. By 2026, around 25% of the global population is expected to use virtual reality (VR) and augmented reality (AR) technology. It’s difficult to tell if VR and AR will become a mainstay channel for consumers, as many people report eyestrain issues during prolonged use. But it opens opportunities for OTT content providers to offer immersive and interactive content, enhancing the overall viewing experience and expanding the possibilities for storytelling and engagement.

The future of OTT streaming is undoubtedly bright, with soaring revenues, growing user bases, and evolving industry trends. As traditional TV faces challenges, OTT streaming providers must focus on overcoming subscription fatigue, exploring VR and AR technologies, personalizing content, and optimizing advertising strategies to maintain their momentum.

Key Statistics

- Global revenue for traditional TV is expected to shrink at a -0.8% CAGR, from $231 billion USD in 2021 to $222.1 billion USD in 2026.

- By 2026, around 25% of the global population is expected to use VR and AR technology.

The advertisers who can adapt and innovate in this rapidly changing landscape will undoubtedly benefit from the OTT streaming revolution and redefine how we consume content in the coming years. tvScientific can help advertisers take advantage of the industry’s growth, ensuring that their marketing material is seen by the right people at the right time. Request a demo today to see how the platform can help your brand grow.